How "Top Reasons Why You Should Use a Credit Memo in Your Business" can Save You Time, Stress, and Money.

Dealing with client conflicts can be a daunting task for any service manager or manager. It’s vital to deal with these disputes with treatment, reliability, and respect. One technique to carry out this is by providing a credit score memo to the client. A credit scores memo is a record that supplies the customer along with a credit history for goods or solutions that were not acceptable or were not received at all. In this short article, we are going to explain how to manage customer disputes along with a credit memo.

Identify the Problem

The initial action in dealing with any consumer conflict is to identify the concern. This indicates listening very carefully to what the consumer has to claim and asking concerns if important. It’s significant to acquire as a lot details as achievable concerning what went wrong and why the customer is unhappy. Once you have pinpointed the issue, you may begin working on a answer.

Take into consideration Issuing a Credit Memo

In some instances, it might be necessary to provide a credit memorandum to the consumer as component of your service. A credit rating memo delivers the customer with credit in the direction of future purchases or reimbursements them for goods or solutions that they have presently paid out for but did not obtain or were not happy along with.

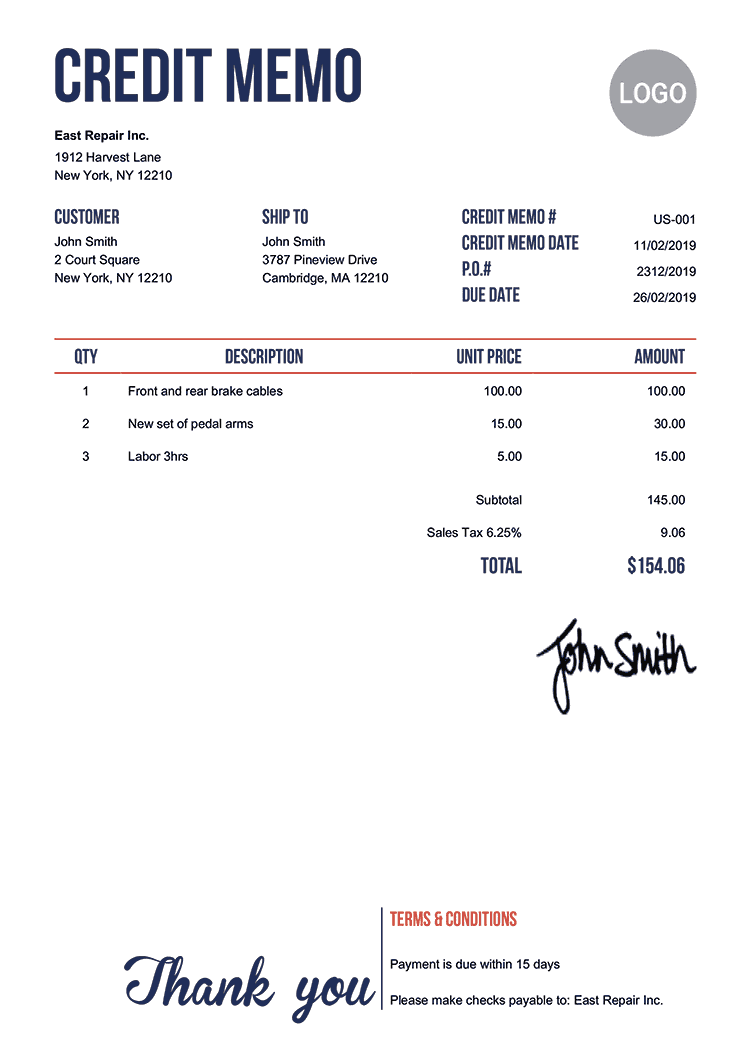

When providing a credit history memorandum, it’s significant to make sure that it consists of all relevant info such as:

- The day of issue

- The reason for issuing the credit

- The amount of the credit rating

- Any sort of phrases and disorders connected along with utilizing the credit report

Communicate Precisely

It’s crucial to correspond plainly and efficiently when taking care of any kind of type of conflict with customers. This implies providing very clear illustrations about what took place, why it took place, and what measures you are taking to address the issue.

When issuing a credit scores memo, produce sure that you describe plainly why you are releasing it and how it will definitely help address their problems. Giving crystal clear interaction helps create trust between you and your consumers which can easily lead to long-term support.

Adhere to Up

Once you have released a credit scores memo, comply with up along with your consumers to guarantee that they are happy with the settlement. https://youtu.be/pF9pTCUKWwk shows that you care regarding their take in and are dedicated to their contentment.

Talk to for Feedback

After settling a disagreement with a customer, it’s vital to talk to for responses. This may assist you determine areas where you can easily enhance your products or services and build stronger connections with your customers.

In addition, if the customer is still unhappy after acquiring a credit score memorandum, it’s crucial to ask them why. This can easily assist you comprehend their issues a lot better and operate towards finding a even more acceptable solution.

Final thought

Managing client disagreements is an inevitable component of functioning any sort of organization. By releasing credit report memos, organizations can easily effectively settle disputes while keeping positive relationships along with their consumers. Bear in mind to recognize the issue, correspond precisely, comply with up, and talk to for comments when managing issues along with customers. These actions will help make sure that your customers experience valued and completely satisfied with your products or solutions.